President Biden recently proposed an ambitious $2 trillion infrastructure plan to fix the nation’s roads and bridges and transition the country to using more “green” technology. While not on board with the entire package, Republicans proposed a counter offer with a $1 trillion price tag.

Most Americans agree that our roads and bridges are essential to our safety, and polling indicates that a majority of the country supports the entire Biden plan. But regardless of whether President Biden gets everything he asks for, there’s a hefty price for either package.

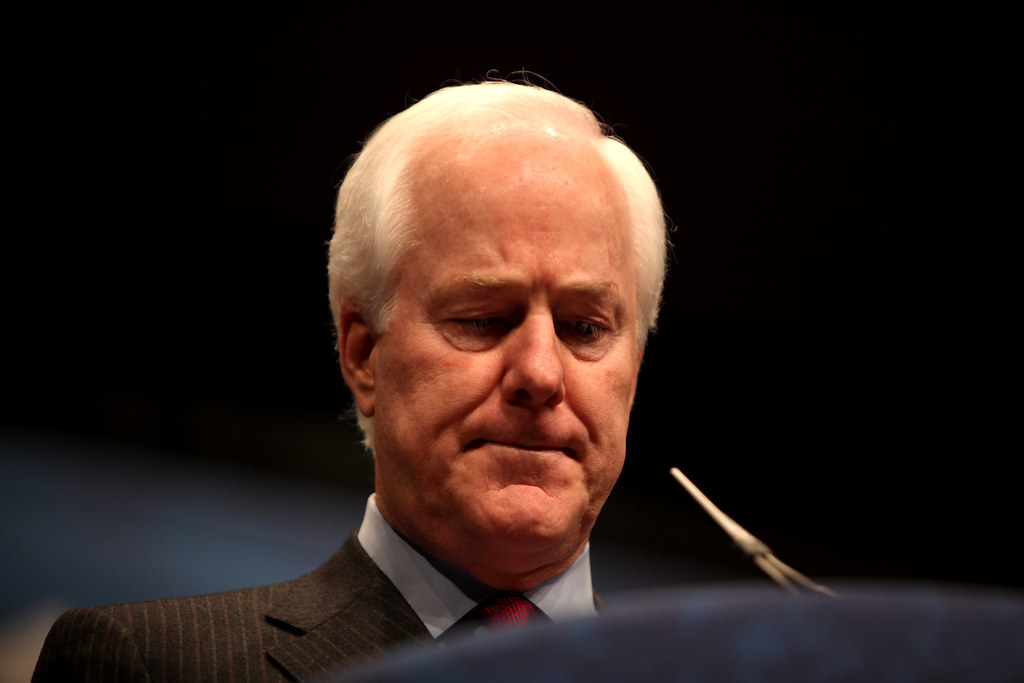

Senator John Cornyn (R-Texas) proposed one solution that didn’t go over well in the trucking industry.

What Did Cornyn Propose?

Senator Cornyn’s proposal was a 25-cent-per-mile tehicle miles travel (VMT) tax on commercial trucks.

This 25 CPM tax would only apply to Class 7 and Class 8 trucks. Class 7 trucks includes semis, garbage trucks, and tow trucks. Class 8 includes trucks over 33,000 lbs, mostly big rigs and dump trucks.

The VMT tax isn’t an original idea from Republican Senator Cornyn, though. From the Biden administration, Transportation Secretary Pete Buttigieg, who has no prior experience in transportation, also raised a possible VMT tax on a few occasions.

Why Is This So Unfair for Truck Drivers?

Senator Cornyn tweeted, “Big trucks do 6x more damage to roads and bridges than private vehicles yet they want you to subsidize them”.

It’s true that trucks do more damage to public roads, but Cornyn misunderstands how taxes work in America. Trucking is a universal good for all citizens.

Trucking is how people got toilet paper during the pandemic as store shelves went barren. Trucking is how people get their groceries. Trucks carry almost everything to their final destination.

We don’t only tax people with children for public schools. We don’t only tax sick people for Medicaid. We don’t only tax elderly people for Social Security.

In America, everyone chips in for a public service, including highways. That doesn’t only include the people that use the service the most.

We do need to fund our public Highway Trust Fund, and the current fuel tax is insufficient. But maybe that tax money can come from those who amassed billions of dollars during the pandemic while drivers were acting as essential workers.

This tax would decimate owner-operators who would have increase their rates just to stay afloat. But owner-ops wouldn’t be the only victims.

Even if a driver works for a big trucking company that can cover the tax, the costs incurred may eventually be taken out of a driver’s wages as competition forces trucking companies to offer the lowest rates.

The Trucking Industry Responds With a Collective “NO!”

In response to Senator Cornyn’s tweet, the American Trucking Association (ATA) tweeted a strong riposte:

“Why does John Cornyn hate truckers? These are the men and women delivering milk, eggs, toilet paper and vaccines across the country. We don’t understand why he wants to tax the hardest working, most patriotic people in America.”

The Owner Operator Independent Drivers Association (OOIDA) pointed to the many complications regarding a VMT tax. Current law only allows Electronic Logging Devices (ELDs) to track Hours of Service, and even that is a surveillance that many truckers are uncomfortable with.

A VMT tax would require ELDs to track and report mileage for each vehicle and probably divide the miles into on-duty and off-duty for tracking purposes. Right now, this is illegal, and the systems for reporting aren’t in place.

According to the OOIDA, a VMT tax isn’t just unfair, it’s unfeasible.